Imagine an era of basketball before Michael Jordan. Take it one step further to a level where Nike was only seen as a track shoe. Converse and Adidas controlled the game and surrounded their brands with the NBA’s top talent with the likes of Magic Johnson, Larry Bird and Julius Irving. It’s hard to comprehend, right?!?

Magic Johnson: “When I first came out of college, all the shoe companies came after me and this guy Phil Knight who had just started Nike. All the other companies offered me money, but Nike couldn’t offer me money because they just started. So he said, ‘Stock. I’m going to give you a lot of stock.’ I didn’t know anything about stock. I’m from the inner city. We don’t know about stocks. (Laughs.) Boy, did I make a mistake. I’m still kicking myself. Every time I’m in a Nike Store, I get mad. I could have been making money off of everybody buying Nikes right now.”

Magic Johnson has amassed a fortune exceeding approximately $600 Million throughout his career, but this Nike decision was a big miss and it still stings to this day. Let’s take a look at how big …

Magic was the 1st Overall Pick in the 1979 NBA Draft and Nike went public in 1980. Each share costed .18 Cents Per Share. As a reference point, let’s speculate and say that Nike provided Magic Johnson with $100,000 worth of stock which roughly translates to 550,000 Shares. This is where it gets interesting … Since inception, Nike has conducted “7” 2 for 1 Stock Splits which turns 550,000 Shares into 70,400,000 Shares. Astounding! If you take that new share count and multiply it by the current trading stock price ($89.35) of Nike (NKE) it translates to $6.29 Billion!

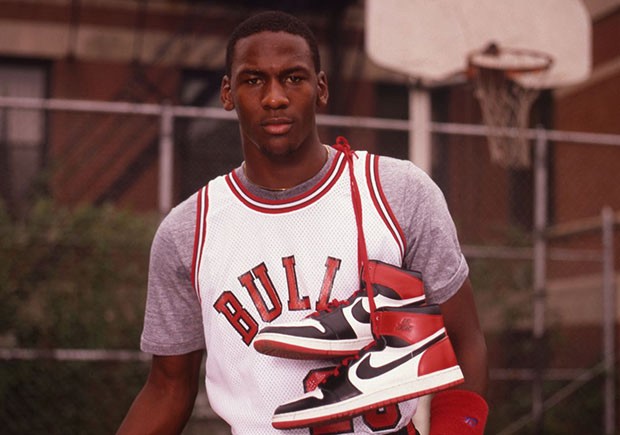

As referenced in ESPN’s “The Last Dance,” Michael Jordan wanted to sign with Adidas and was reluctant to even take the initial endorsement meeting with Nike, but was forced by his parents and agent to at least listen to the pitch. The rest is history and Nike handed MJ a 5-Year Deal totaling $2.5 Million + Royalties. That $500,000 Per Year was actually the entire marketing budget for Nike that year! Since then, Michael Jordan has compiled a fortune worth approximately $1.9 Billion. Nike’s Jordan Brand revenue accounts for nearly 10% of the entire brand and pays Jordan an annual cut of approximately $130 Million, which nets out to be nearly 4 times higher than Lebron James’ annual earnings from Nike at $32 Million. In 2019, Jordan made approximately $145 Million from ongoing endorsements and other businesses, but what still sticks out is that 90% of his annual income still comes from Nike and will likely only grow as the brand continues to expand internationally and into China.

[youtube id=”nWi_VZlIhP0″]

Similar to our example above for Magic Johnson, let’s do the same for Michael Jordan. Let’s say your investment strategy is simple. Peter Lynch simple … “Buy what you know.” These type of stories are always so hypothetical … Imagine if you bought Apple at this price or Amazon at this price when it first debuted on the stock market … Blah, Blah, Blah. Nearly impossible to predict, right? I’m with ya! But in this case, it’s sports. People understand that. People don’t understand why one tech company is a high-flyer and another is a dud. But … What if you just followed what you knew. What if you just believed in the talent that was Michael Jordan? It’s the 1980’s, Air Jordan has taken North Carolina by storm winning a National Championship in 1982, then won a gold medal in the 1984 Olympics and continued his ascension further as the 3rd Pick in the 1984 NBA Draft. Jordan then signs with Nike that same year and Nike has a Stock Price of .18 Cents Per Share.

$1,000 lands you approximately 5,500 Shares. As we explained above, Nike’s Stock has split 2-for-1 “7 Times” which translates your share count into 704,000 Shares as of today. The current share price of Nike sits at $89.35. 704,000 Shares x $89.35 = $62,900,000. We didn’t calculate this for the Magic Johnson example, but Nike pays a dividend with a yield of 1.11%. Therefore, 1.11% of your now $62,900,000 investment in Nike would pay you $692,000 per year in dividend income! We aren’t going into the weeds any further, but just remember that Warren Buffett said, “The 8th Wonder of the World is compounding interest.” If you compounded the dividend back into the stock instead of taking that dividend payment for the past 40 Years, that value reaches an even higher and staggering amount!

As we take a step back from this, you truly have to wonder … Would Nike have elevated to a company anywhere near where they are today without Michael Jordan? Nike is currently valued at approximately $140 Billion. Would they have remained simply a running shoe company? What if Jordan went with Adidas? As MJ said in the interview above, “It’s hard to say. The word “if” should never be in the dictionary because you can’t ever see the flip-side of that.” However, as I finish the last sentence of this article and lace up my own pair of Nike’s, my opinion … Probably not.

[youtube id=”JA7G7AV-LT8″]